Amendment 5 Florida Voting: Unveiling Voter Rights!

Amendment 5 Florida Voting, which touches upon voter rights, involves several key entities. The Florida Constitution outlines the fundamental legal framework. The League of Women Voters provides resources and advocacy related to voter education. The Supervisor of Elections office in each Florida county manages local voting processes. And Voter ID requirements ensure voter verification at polling places. Understanding these components is critical to understanding amendment 5 florida voting and the complexities of voter rights in Florida.

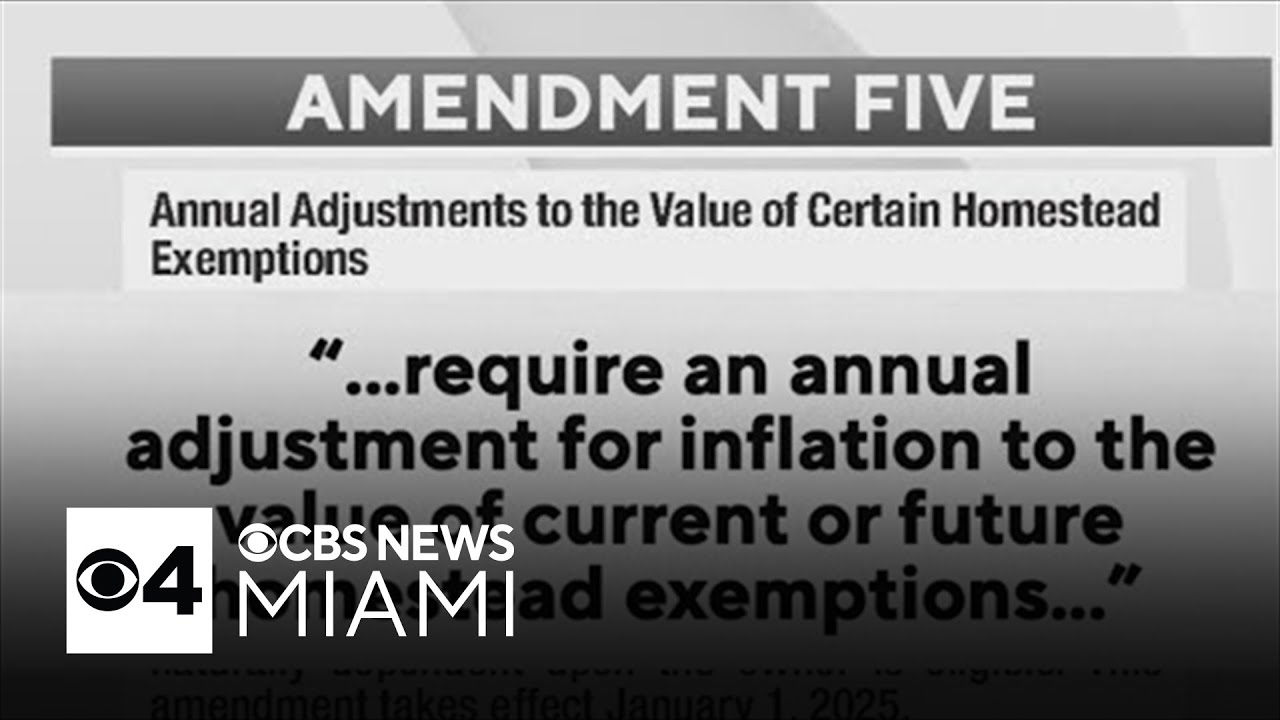

Image taken from the YouTube channel CBS Miami , from the video titled Florida voters to decide Amendment 5, homestead exemption adjustments .

Amendment 5 Florida Voting: Unveiling Voter Rights!

This article aims to provide a comprehensive and objective explanation of Amendment 5 related to Florida voting rights. It will delve into its key provisions, historical context, and potential impact on Florida voters.

Understanding Amendment 5: An Overview

Amendment 5 to the Florida Constitution deals with the process of amending the constitution itself, and how it impacts voting on potential amendments. This section will provide a clear definition and purpose of the amendment.

What is Amendment 5?

Amendment 5 focuses on requiring proposed constitutional amendments to include in the ballot title and summary their projected impact on the state budget, and any increases or decreases in taxes.

The Core Purpose of Amendment 5

The fundamental goal of Amendment 5 is to ensure voters are better informed about the potential financial consequences of approving a constitutional amendment. Transparency in the amendment process is the central aim. This allows voters to cast informed ballots based on a clearer understanding of not just the intended purpose, but also the likely financial impact.

Key Provisions of "Amendment 5 Florida Voting"

This section will break down the specific provisions contained within the amendment, clarifying what it legally stipulates.

-

Budgetary Impact Statements: A critical component is the requirement for a "financial impact statement" to be included on the ballot. This statement must detail the estimated effect the amendment will have on state revenue or expenditures, within a certain timeframe.

-

Inclusion on Ballot: The ballot title and summary of any proposed amendment must include the financial impact statement. This ensures voters are presented with this information at the point of voting.

-

Objectivity & Accuracy: These financial impact statements are expected to be based on careful analysis and objective assessment to avoid bias or misinformation.

Historical Context of Amendment 5

Understanding the history leading up to Amendment 5 helps explain its motivations.

Circumstances Leading to the Amendment

Concerns over poorly understood or misrepresented financial consequences associated with previously passed constitutional amendments fueled the push for Amendment 5. There was a perception among some lawmakers and the public that voters were not always fully aware of the long-term budgetary implications of their votes on amendments.

The Legislative Process

Briefly outline the legislative process through which the amendment was proposed and ultimately placed on the ballot for voter approval. This includes the roles of the Florida legislature and any relevant committees.

Implications for Florida Voters

This section will analyze the potential effects of Amendment 5 on the voting experience and voter behavior.

Increased Voter Awareness

The intended outcome is to increase voter awareness of the financial ramifications of approving constitutional amendments. By having this information readily available, voters can weigh the potential budgetary effects alongside the policy objectives of the amendment.

Potential for Biased Statements

There remains the potential that financial impact statements could be subject to interpretation or manipulation, potentially influencing voter choices. Rigorous oversight and transparency in the statement generation process are vital to mitigate this risk.

Analyzing the Financial Impact Statement

A deeper look into the nature and content of the financial impact statement is crucial.

What Information Must be Included?

- Estimates of revenue increases or decreases.

- Projections for expenditure changes.

- The time frame the impact statement covers.

- The methodology used to arrive at the estimates.

Who is Responsible for Creating the Impact Statement?

Typically, a state government entity, such as the Office of Economic and Demographic Research (OEDR), or a similar body, is responsible for preparing the financial impact statement. This body is ideally chosen for its expertise and impartiality.

Challenges and Criticisms of "Amendment 5 Florida Voting"

This section presents counter-arguments or potential drawbacks.

-

Subjectivity of Estimates: Financial projections are inherently subject to uncertainty and potentially influenced by political or economic considerations. Critics argue that these estimates could be used to mislead voters.

-

Increased Ballot Complexity: Some contend that adding more information to the ballot could confuse voters, especially those with limited literacy or understanding of financial matters. Simplifying the language and presentation of the impact statement is important to avoid this problem.

-

Unintended Consequences: It’s possible the requirement for financial impact statements could discourage the proposal of potentially beneficial amendments due to perceived negative financial implications, even if the long-term benefits outweigh the costs.

Examples of Past Amendments Affected

Show how Amendment 5 would have affected past initiatives.

| Amendment | Brief Description | How Amendment 5 Would Have Changed the Ballot |

|---|---|---|

| Amendment X (Fictional) | Dedicated a portion of state lottery funds to environmental protection | Ballot would have needed to detail the estimated decrease in lottery funds available for education due to the dedication to environmental protection. |

| Amendment Y (Fictional) | Increased the state minimum wage. | Ballot would have needed to detail the projected increase in state payroll costs and the potential effect on state revenue due to increased business costs. |

Video: Amendment 5 Florida Voting: Unveiling Voter Rights!

Amendment 5 Florida Voting: FAQs

Here are some frequently asked questions about Amendment 5 in Florida and how it affects voting rights in the state.

What is Amendment 5 Florida Voting about?

Amendment 5, concerning the Legislature's power over rules of evidence, affects civil and criminal court cases, including those related to election disputes. It clarifies that the Florida Legislature holds the power to prescribe the rules of evidence in any court.

How does Amendment 5 potentially impact voting rights in Florida?

While not directly addressing voter registration or ballot access, amendment 5 florida voting could influence how evidence is presented and interpreted in election-related lawsuits. This indirectly affects the legal challenges pertaining to voting rights.

Did Amendment 5 change voter eligibility requirements?

No, Amendment 5 Florida voting did not change any existing eligibility requirements for voters in Florida. It primarily deals with the rules of evidence used in court proceedings. It has nothing to do with voter identification, registration, or other aspects of voter qualifications.

What are the key arguments surrounding Amendment 5's impact on legal challenges to voting laws?

Arguments center on whether the Legislature setting the rules of evidence could make it more difficult or easier to prove violations of voting rights. Some believe it allows the legislature to potentially skew the legal landscape in favor of certain voting laws, making it harder to challenge laws in court.