Duplex in Florida: Invest or Miss Out on This Hot Market!

The Florida real estate market presents diverse opportunities, and duplex in Florida ownership stands out as a compelling investment strategy. Investors considering avenues such as property management should pay close attention to the factors that make this market appealing. With favorable tax incentives and a vibrant rental environment, the demand for duplex in Florida remains robust. Understanding the impact of local HOA regulations on property values, alongside guidance from a qualified real estate attorney, is crucial for successful investment. Moreover, examining recent population growth trends will offer insights into potential rental income streams and the long-term profitability of a duplex in Florida.

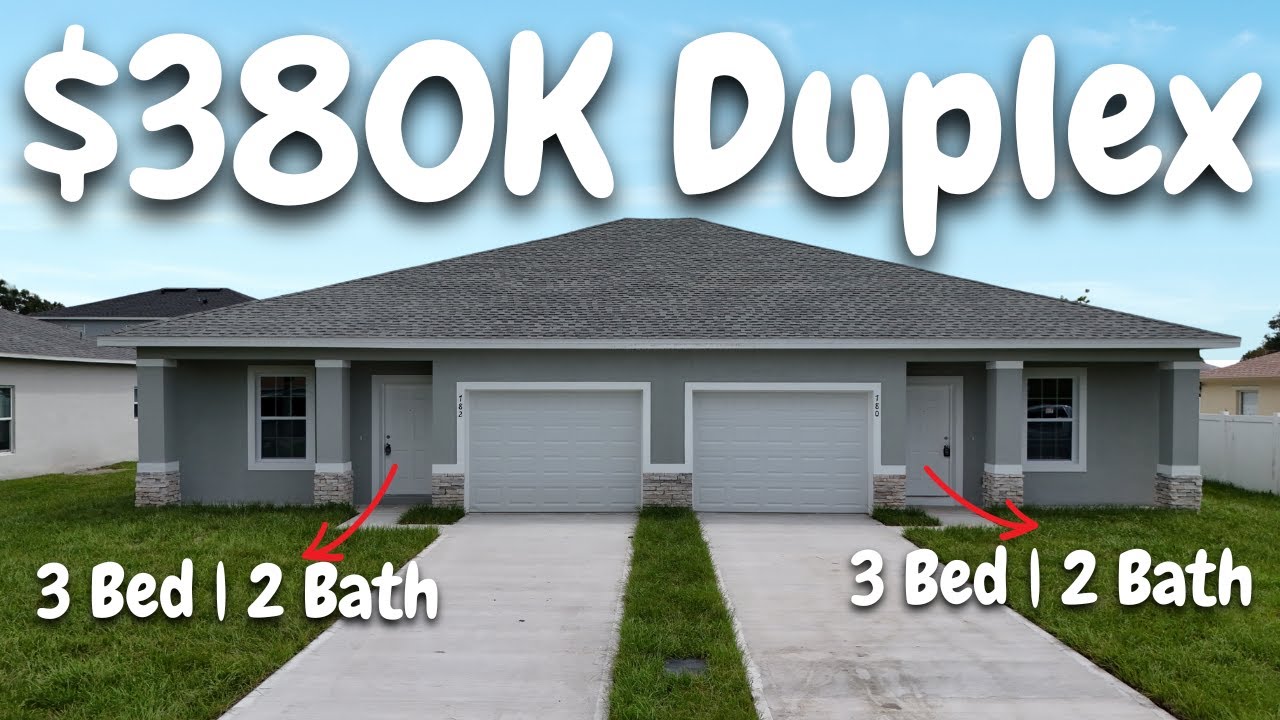

Image taken from the YouTube channel Marlon J. Persaud , from the video titled Build your own Duplex for $380K in Central Florida! .

Structuring Your "Duplex in Florida: Invest or Miss Out on This Hot Market!" Article

This outlines a suggested article layout to effectively cover the topic of investing in a "duplex in Florida," focusing on its potential benefits and risks within the current market conditions.

Introduction: Hooking the Reader and Setting the Stage

- Grab the reader's attention: Start with a compelling statistic about Florida's real estate market growth or the increasing popularity of duplexes. Consider mentioning the allure of Florida living.

- Introduce the central question: Explicitly state the article's purpose: Is investing in a "duplex in Florida" a smart move right now, or is it an overhyped opportunity?

- Briefly outline the article's structure: Tell the reader what topics will be covered, setting expectations for a comprehensive analysis. For example: "We will explore the current market conditions, potential income streams, financing options, and the pros and cons of managing a duplex in Florida."

Understanding the Florida Real Estate Landscape

- Provide a general overview of the Florida real estate market.

- Mention key trends (e.g., population growth, migration patterns, tourism impact).

- Highlight areas with the most significant growth and demand.

- Focus on the specific regions where duplexes are popular.

- Identify cities or counties within Florida where duplex investment is prevalent (e.g., South Florida, Orlando, Tampa).

- Explain why these regions are attractive for duplex ownership (e.g., rental demand, affordability compared to single-family homes).

- Current Market Conditions for Duplexes in Florida

- Analyze the inventory levels: Are there plenty of duplexes for sale, or is it a seller's market?

- Examine price trends: Are duplex prices increasing, decreasing, or remaining stable? Include data to support your analysis.

- Compare duplex prices to other real estate options: How do duplexes compare to single-family homes or apartments in the same area?

The Allure of Investing in a Duplex

- Income Potential:

- Explain the concept of dual income streams from renting out both units.

- Provide examples of potential rental income based on location and property size. Consider using a range (e.g., "$X to $Y per month per unit").

- Discuss strategies for maximizing rental income (e.g., short-term rentals, tenant screening).

- Mortgage Assistance:

- Explain how renting out one unit can help offset mortgage costs.

- Provide a hypothetical scenario illustrating how rental income can contribute to mortgage payments.

- Tax Benefits:

- Briefly mention potential tax deductions associated with owning a rental property (e.g., depreciation, mortgage interest). Disclaimer: Consult with a tax professional for personalized advice.

- Building Equity:

- Describe how property value appreciation and mortgage paydown contribute to equity growth.

Due Diligence: Evaluating the Risks

- Property Management Challenges:

- Discuss the responsibilities of managing a duplex (e.g., tenant screening, maintenance, repairs).

- Outline the costs associated with property management (e.g., hiring a property manager, repair expenses).

- Weigh the pros and cons of self-management versus hiring a professional.

- Vacancy Risk:

- Explain the potential financial impact of having vacant units.

- Discuss strategies for minimizing vacancy periods (e.g., effective marketing, competitive rental rates).

- Tenant Issues:

- Address potential issues with tenants (e.g., late payments, property damage, disputes).

- Emphasize the importance of thorough tenant screening and clear lease agreements.

- Market Fluctuations:

- Acknowledge that real estate markets are subject to change.

- Discuss factors that could negatively impact the value of a "duplex in Florida" (e.g., economic downturn, overbuilding).

Financing Your Duplex Purchase

- Traditional Mortgage Options:

- Outline the requirements for securing a traditional mortgage for a duplex (e.g., credit score, down payment).

- Discuss different types of mortgage loans (e.g., fixed-rate, adjustable-rate).

- Investment Property Loans:

- Explain the differences between mortgages for primary residences and investment properties.

- Highlight potential lenders specializing in investment property loans.

- Other Financing Options:

- Briefly mention alternative financing options (e.g., hard money loans, private lenders).

- The importance of Getting Pre-Approved

Case Studies & Examples

- Showcase successful duplex investments in Florida.

- Present real-world examples of individuals or companies who have found success with duplexes in Florida.

- Include data on purchase price, rental income, expenses, and return on investment (ROI).

- Highlight potential pitfalls and lessons learned.

- Share examples of unsuccessful duplex investments and the reasons for their failure (e.g., poor location, inadequate property management).

Resources for Further Research

- Local Real Estate Agents:

- Recommend reputable real estate agents specializing in investment properties.

- Property Management Companies:

- Provide a list of property management companies in Florida.

- Online Resources:

- Link to relevant websites and databases for real estate data and market analysis.

By following this detailed layout, you can create a comprehensive and informative article that helps readers understand the potential opportunities and risks associated with investing in a "duplex in Florida." This will establish your article as a valuable resource for anyone considering this investment strategy.

Video: Duplex in Florida: Invest or Miss Out on This Hot Market!

FAQs About Investing in a Florida Duplex

Here are some frequently asked questions about investing in a duplex in Florida and whether it's the right move for you.

Is Florida still a good place to invest in a duplex?

Yes, Florida remains an attractive real estate market, especially for duplexes. Factors like population growth and tourism contribute to sustained demand for rental properties, making a duplex in Florida a potentially profitable investment. However, location and market conditions should always be thoroughly researched.

What are the main benefits of owning a duplex in Florida?

Owning a duplex in Florida offers several advantages. You can live in one unit and rent out the other, effectively covering your mortgage. It's also a way to diversify your investment portfolio and potentially benefit from both rental income and property appreciation.

What should I consider before buying a duplex in Florida?

Before buying a duplex in Florida, consider factors like location, property condition, rental rates, and potential expenses. Thoroughly research the neighborhood's desirability, check for any structural issues with the building, and factor in costs like property taxes, insurance, and property management fees. Understand the local regulations related to owning and renting a duplex in Florida.

What's the best way to finance a duplex purchase in Florida?

You have several financing options for a duplex in Florida, including conventional mortgages, FHA loans (if you plan to live in one unit), and VA loans (if you're eligible). Shop around for the best interest rates and loan terms, and be prepared to provide a down payment and documentation of your income and credit history.