Florida Storm Damage Claims: Get What You Deserve!

Florida homeowners often face the daunting task of navigating insurance claims after a severe weather event. The Florida Department of Financial Services provides resources to assist residents, but understanding your policy remains crucial. Public adjusters, like those certified by the National Association of Public Insurance Adjusters (NAPIA), can advocate on your behalf to ensure you receive a fair settlement for storm damage in florida. This article arms you with the knowledge you need to successfully file a claim and get what you deserve.

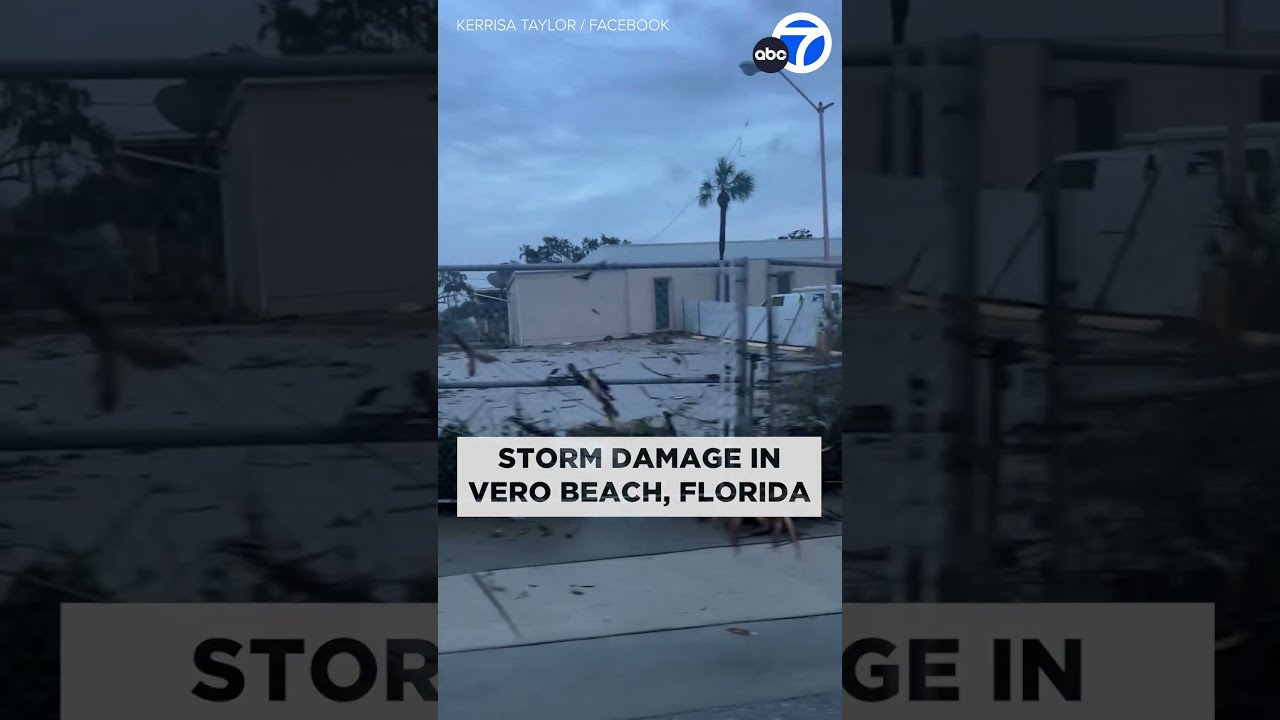

Image taken from the YouTube channel ABC Action News , from the video titled Florida mobile home residents getting eviction notices on top of storm damage .

Understanding Florida Storm Damage Claims to Ensure Fair Compensation

This guide provides a structured approach to understanding Florida storm damage claims and how to navigate the process effectively to receive the compensation you are rightfully owed. We will focus on the essential elements and best practices for filing, documenting, and pursuing your claim.

What Constitutes "Storm Damage in Florida"?

Understanding what qualifies as storm damage is the first step. Florida's unique climate makes it susceptible to various types of storms.

Common Types of Storms

- Hurricanes: These bring high winds, heavy rainfall, and potential flooding.

- Tropical Storms: Similar to hurricanes but with lower wind speeds.

- Severe Thunderstorms: Can cause hail, strong winds, and lightning strikes.

- Tornadoes: Though less frequent than other storms, they can cause significant localized damage.

- Flooding: Regardless of the storm type, flooding is a major concern.

What Kind of Property Damage is Covered?

Coverage depends on your insurance policy, but generally includes:

- Wind Damage: Roof damage (shingles, tiles), siding damage, broken windows.

- Water Damage: Resulting from roof leaks, broken windows, or flooding. Important Note: Flood damage typically requires separate flood insurance.

- Hail Damage: Dents and dings to roofs, cars, and other property.

- Lightning Damage: Electrical surges that damage appliances or cause fires.

- Damage from Falling Trees or Debris: Caused by wind or storm surge.

Documenting "Storm Damage in Florida"

Thorough documentation is crucial for a successful claim.

Before the Storm (Preparation):

- Inventory of Possessions: Keep a detailed list of your belongings, ideally with photos or videos, including purchase dates and estimated values.

- Insurance Policy Review: Understand your coverage, deductibles, and policy limitations before a storm hits.

- Secure Your Property: Trim trees, clear gutters, and secure loose items that could become projectiles.

After the Storm (Evidence Gathering):

- Safety First: Ensure it is safe to assess the damage. Avoid downed power lines or structurally unsound areas.

- Photographic and Video Evidence:

- Take extensive photos and videos of all damaged areas, both inside and outside your property.

- Capture overall views of the damage and close-up shots of specific issues.

- Include photos of damaged personal belongings.

- Prevent Further Damage (Mitigation):

- Take reasonable steps to prevent further damage. This might include covering a leaking roof with a tarp or boarding up broken windows. Save all receipts for these repairs, as they are often reimbursable.

- Keep Detailed Records:

- Maintain a log of all communication with your insurance company, including dates, times, and names of representatives.

- Keep copies of all documents related to your claim.

Filing Your "Storm Damage in Florida" Claim

Filing the claim correctly and promptly is critical.

Contacting Your Insurance Company

- Report the Damage Immediately: Call your insurance company as soon as possible after the storm.

- Request a Claim Number: Obtain a claim number for future reference.

- Provide Detailed Information: Be prepared to provide:

- Your policy number

- A description of the damage

- The date and time the damage occurred

- Your contact information

Understanding the Claims Process

The typical claims process involves these steps:

- Initial Claim Submission: You file your claim with your insurance company.

- Insurance Adjuster Inspection: An adjuster will be sent to inspect the damage. Be present during the inspection and point out all damage you've identified.

- Review of Policy Coverage: The insurance company reviews your policy to determine coverage.

- Damage Estimate: The insurance company prepares an estimate of the cost to repair or replace the damage.

- Claim Settlement: The insurance company makes a settlement offer.

- Negotiation (If Necessary): You negotiate with the insurance company if you disagree with the settlement offer.

Working with the Insurance Adjuster

- Be Prepared: Have your documentation ready and be prepared to answer questions about the damage.

- Be Cooperative, but Assertive: Answer their questions honestly, but don't be afraid to point out damage they may have missed.

- Take Notes: Keep detailed notes of the adjuster's comments and findings.

- Get Everything in Writing: Obtain a written copy of the adjuster's report.

Addressing Claim Disputes for "Storm Damage in Florida"

Sometimes, insurance companies deny or undervalue claims. Here's how to address disputes:

Understanding Why Your Claim Was Denied or Undervalued

- Review the Denial Letter: Carefully read the denial letter to understand the reason for the denial. Common reasons include:

- Damage not covered by the policy

- Damage pre-existing

- Deductible not met

- Policy exclusions

- Gather Additional Evidence: If you believe the denial is unjustified, gather additional evidence to support your claim. This could include:

- Independent repair estimates

- Expert opinions (e.g., from a structural engineer)

- Weather reports

Options for Resolving Disputes

- Internal Appeal: Most insurance companies have an internal appeals process. File an appeal and provide any additional evidence to support your claim.

- Mediation: Mediation involves a neutral third party who helps you and the insurance company reach a settlement agreement.

- Public Adjuster: Hire a public adjuster to represent your interests. Public adjusters are licensed professionals who can assess your damage, negotiate with the insurance company, and help you get a fair settlement. Note: They charge a fee, typically a percentage of the settlement.

- Legal Action: As a last resort, you can file a lawsuit against the insurance company. Consult with an attorney specializing in insurance claims.

Video: Florida Storm Damage Claims: Get What You Deserve!

Florida Storm Damage Claims: Frequently Asked Questions

Here are some frequently asked questions regarding Florida storm damage claims to help you understand the process and ensure you get what you deserve.

What kind of storm damage in Florida is typically covered by insurance?

Most standard homeowner's insurance policies cover damage caused by wind, hail, lightning, and rain. However, flood damage is typically excluded and requires a separate flood insurance policy. Understanding your policy specifics is crucial.

What should I do immediately after my property sustains storm damage in Florida?

First, ensure your safety and the safety of others. Then, document the damage with photos and videos. Report the damage to your insurance company as soon as possible and take reasonable steps to prevent further damage, like covering a damaged roof with a tarp.

What if my insurance company denies or undervalues my Florida storm damage claim?

You have options. You can dispute the insurance company's decision by providing additional evidence, obtaining independent assessments, or filing a complaint with the Florida Department of Financial Services. You may also consider consulting with a public adjuster or an attorney specializing in storm damage in Florida.

How long do I have to file a storm damage claim in Florida?

Florida law sets deadlines for filing insurance claims. While the exact timeframe may vary depending on your policy and the type of loss, it's generally best to file your claim as soon as possible after the storm. Missing the deadline could jeopardize your ability to recover compensation for storm damage in Florida.