Florida Tax-Free: The ULTIMATE Savings Guide REVEALED!

The Florida Department of Revenue administers various programs, a key function being oversight of Florida tax-free initiatives that benefit residents and visitors alike. Qualified hurricane preparedness supplies often become eligible for sales tax exemptions, representing a substantial saving for families preparing for potential storms. Retailers participating in Florida's back-to-school sales tax holiday offer opportunities to purchase essential school supplies florida tax free, lightening the financial load for parents. Furthermore, awareness of these savings opportunities empowers consumers to manage their budgets effectively and support the Florida economy through informed spending decisions.

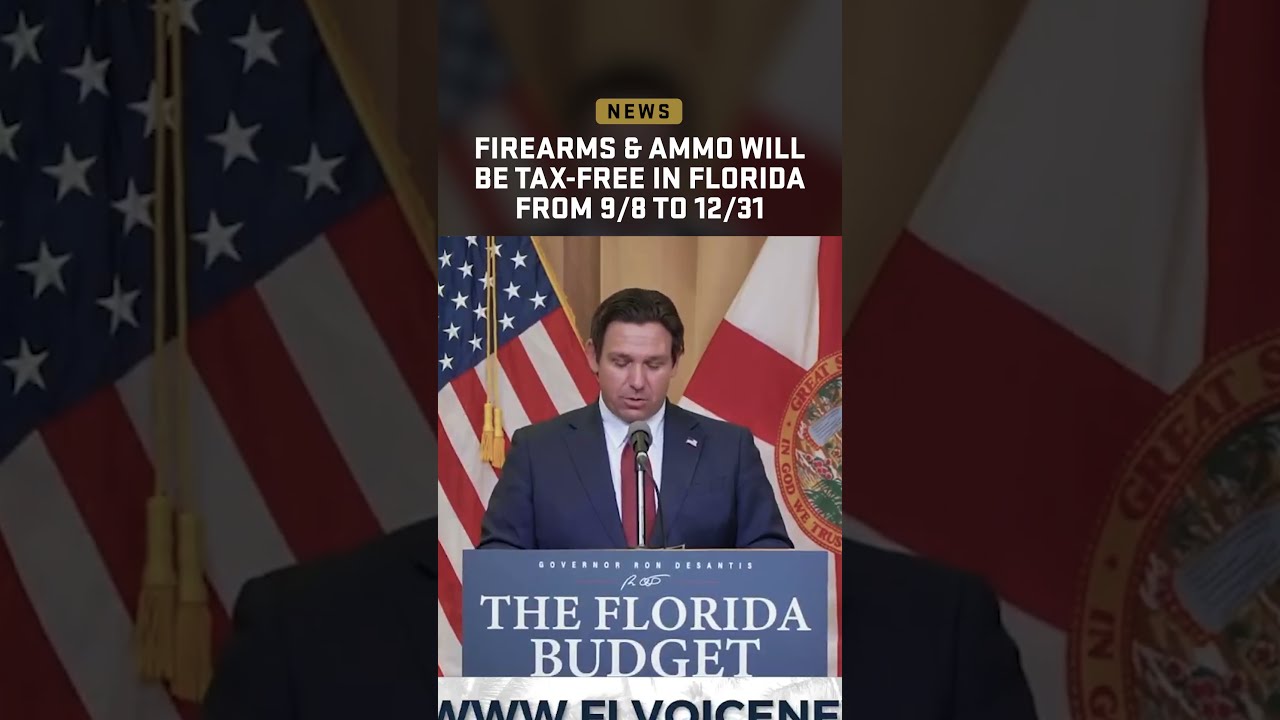

Image taken from the YouTube channel USCCA , from the video titled Firearms & Ammo Will Be Tax-Free in Florida from 9/8 to 12/31 .

Florida, renowned for its sun-kissed beaches and vibrant culture, also offers a unique opportunity for savvy shoppers: tax-free shopping. Imagine purchasing back-to-school necessities, hurricane preparedness supplies, or even upgrading your home office without the added burden of sales tax.

This isn't a year-round phenomenon, but rather a strategically implemented series of events known as Florida Sales Tax Holidays.

These designated periods provide a valuable window to acquire essential items while keeping more money in your pocket.

The Promise of Florida Sales Tax Holidays

This guide serves as your comprehensive roadmap to navigating and maximizing these tax-free opportunities. We'll demystify the intricacies of each holiday, outlining specific dates, eligible items, and crucial guidelines to ensure you reap the full benefits.

Our aim is simple: to empower you with the knowledge to make informed purchasing decisions and strategically plan your shopping sprees.

Unveiling the Ultimate Savings Secrets

Think of this guide as your personal key to unlocking hidden savings potential. We'll go beyond the surface-level information, delving into practical examples, addressing common misconceptions, and providing insider tips to optimize your tax-free shopping experience.

By mastering the art of timing and understanding the nuances of eligibility, you can transform ordinary purchases into significant savings.

Prepare to uncover the ultimate savings secrets and embark on a journey to financial empowerment in the Sunshine State. This guide is your first step towards becoming a tax-savvy shopper and making the most of Florida's unique tax-free landscape.

Understanding Florida's Tax-Free Landscape

Before diving into the specifics of each holiday, it's crucial to grasp the fundamental principles that govern Florida's tax-free periods. Understanding how these holidays function, who orchestrates them, and their inherent limitations is key to maximizing your savings potential.

What are Sales Tax Holidays?

Sales tax holidays are temporary periods during which the state of Florida exempts certain goods from sales tax. Think of them as limited-time opportunities to purchase specific items without paying the usual state sales tax rate, which can range from 6% to 7.5% depending on the county.

This isn't a permanent removal of sales tax; rather, it's a strategically implemented initiative designed to stimulate the economy and provide financial relief to consumers. The concept is simple: By removing the tax burden on essential goods, individuals and families can save money, which can then be reinvested back into the local economy.

The Role of the Florida Department of Revenue

The Florida Department of Revenue (DOR) serves as the primary governing body overseeing all sales tax-related matters, including the implementation and administration of sales tax holidays.

The DOR is responsible for establishing the specific guidelines, eligible items, and duration of each holiday. They also provide crucial information and resources to both consumers and businesses to ensure compliance.

Resources Provided by the Department of Revenue

Their website is the official source for the most up-to-date information, clarifying any ambiguities and outlining the precise rules that apply. This includes lists of specific items that qualify for exemption, as well as guidance for retailers on how to properly handle tax-free sales.

Visiting the DOR website is essential for accurate information.

The Importance of Planning Ahead

One of the most critical aspects of Florida's sales tax holidays is their limited duration. These are not year-round benefits. Each holiday is carefully scheduled for a specific period, usually lasting a few days to a week. This is why proactive planning is essential.

Don't wait until the last minute to make your purchases. Start by identifying the items you need and checking the DOR website to confirm their eligibility. By planning ahead, you can avoid the crowds and ensure that you make the most of these valuable opportunities.

Key Considerations for Planning

Keep in mind that certain items may have price limits to qualify for the tax exemption. Planning helps you stay within these limits.

Furthermore, popular items may sell out quickly, so arriving early or shopping online (if applicable) can increase your chances of securing the desired products.

Finally, mark your calendar and set reminders to ensure you don't miss out on these valuable tax-saving periods.

The Department of Revenue serves as the official source for all things sales tax-related, but understanding how to leverage that information for real-world savings is where the true value lies. Let's now examine one of Florida's most popular sales tax holidays in more detail.

Back-to-School Sales Tax Holiday: Maximizing Education Savings

The Back-to-School Sales Tax Holiday is a highly anticipated event for Florida families. It offers a significant opportunity to reduce the financial burden associated with preparing children for the academic year.

This holiday isn't just about saving a few dollars; it's about making education more accessible.

This section provides a detailed breakdown of this important holiday, ensuring you can make the most of it.

Dates and Duration

The Back-to-School Sales Tax Holiday occurs annually, typically in late July or early August. The exact dates can vary from year to year.

It's essential to consult the Florida Department of Revenue's website for the official dates each year. The holiday usually spans for a period of ten days to two weeks.

This timeframe allows ample opportunity for parents and students to purchase necessary items without the added expense of sales tax. Make sure to mark your calendars and plan your shopping accordingly!

Eligible Items: Clothing, School Supplies, and Computers

The Back-to-School Sales Tax Holiday focuses on essential items commonly needed for students. The eligible categories are clothing, school supplies, and computers.

However, there are specific price limits and qualifications for each category. Let's break them down.

Clothing

Clothing items are exempt from sales tax if they are priced at \$100 or less per item.

This includes a wide range of apparel, from shirts and pants to dresses and shoes. Accessories like jewelry and watches are generally not included.

School Supplies

School supplies are tax-exempt if they are priced at \$50 or less per item.

This category encompasses a broad range of items, including notebooks, pens, pencils, erasers, binders, and calculators.

Larger items, such as furniture and certain electronic devices beyond calculators, are typically not included.

Computers

Computers and related accessories are tax-exempt if priced at \$1,500 or less.

This includes desktop computers, laptops, tablets, and related accessories like keyboards, mice, and monitors. Software is also typically included.

Examples and Common Misconceptions

To further clarify what qualifies for the sales tax exemption, let's look at some examples and address common misconceptions.

Qualifying Items:

- A \$25 pair of jeans

- A \$10 pack of pencils

- A \$1,200 laptop

- A \$45 scientific calculator

- A \$99 dress shirt

Non-Qualifying Items:

- A \$150 leather jacket

- A \$60 graphing calculator

- A \$2,000 gaming computer

- Jewelry, watches, or wallets

- Rental or repair of qualifying items

Common Misconceptions:

- Everything is tax-free: Not all items qualify. It's essential to stay within the specified categories and price limits.

- The holiday applies to all retailers: While most retailers participate, it's always a good idea to confirm with the specific store you plan to shop at.

- You can get a refund on taxes paid before the holiday: The exemption only applies during the designated holiday period.

Understanding these details can help you avoid confusion and ensure you maximize your savings during the Back-to-School Sales Tax Holiday. Proper planning is key!

Disaster Preparedness Sales Tax Holiday: Protecting Your Home & Wallet

Floridians know all too well the importance of being prepared for hurricane season. The Disaster Preparedness Sales Tax Holiday offers a crucial opportunity to stock up on essential supplies without the added burden of sales tax.

It’s a proactive measure designed to encourage residents to safeguard their homes and families before disaster strikes.

Timing is Everything: Hurricane Season and Tax Relief

The Disaster Preparedness Sales Tax Holiday is strategically timed to coincide with the approach of hurricane season, which officially begins June 1st and ends November 30th. The holiday typically occurs in late May or early June, giving residents ample time to prepare before potential storms threaten.

This timing is no accident; it's a deliberate effort to incentivize early preparation. By offering tax relief before the peak of hurricane activity, the state aims to reduce the strain on resources and ensure that individuals are better equipped to weather the storm. Always confirm the exact dates each year with the Florida Department of Revenue, as they are subject to change.

Essential Items: Building Your Emergency Kit, Tax-Free

The holiday focuses on specific items deemed essential for hurricane preparedness. The list is carefully curated to include goods that can help you protect your home, communicate with the outside world, and sustain yourself and your family during and after a storm.

It's more than just saving money, it's about securing peace of mind. Let’s explore some of the key categories and examples of eligible items:

Power & Communication

- Batteries: All sizes are typically included, powering essential devices like flashlights and radios.

- Radios: Crucial for receiving weather updates and emergency broadcasts when other communication channels are down. Look for battery-operated or hand-crank models.

- Weather Radios: NOAA weather radios are specifically designed to receive alerts from the National Weather Service.

Protection & Shelter

- Tarps: Essential for covering damaged roofs or creating temporary shelters.

- Tie-down Kits: Used to secure outdoor furniture and other items that could become projectiles in high winds.

- Ground Anchor Systems: Provide added security for anchoring sheds or other structures.

Safety & First Aid

- First-aid Kits: A well-stocked kit is crucial for treating minor injuries.

- Smoke Detectors & Fire Extinguishers: Ensure these are in working order before a storm hits.

- Carbon Monoxide Detectors: Protect against the silent killer – carbon monoxide poisoning – especially after a storm when generators are in use.

Other Essentials

- Coolers & Ice Packs: To keep food and medications cold in the event of a power outage.

- Reusable Ice: A long-lasting alternative to traditional ice.

- Portable Generators: While often a significant investment, smaller generators under a certain price threshold may qualify. Check specific limitations.

Important Note: Price limits apply to many of these items. The Florida Department of Revenue provides a detailed list of eligible items and their corresponding price thresholds on their website. Always consult this official resource to ensure your purchases qualify for the tax exemption.

The Importance of Preparation: Don't Wait Until It's Too Late

The Disaster Preparedness Sales Tax Holiday is more than just a chance to save a few dollars; it's a reminder of the importance of being prepared. Hurricane season can be unpredictable, and being proactive can make all the difference in protecting your home, your family, and your peace of mind.

Take advantage of this opportunity to build or replenish your emergency kit. Don't wait until a storm is on the horizon – prepare now, while you have the time and the tax incentive. Being prepared not only safeguards your well-being but also contributes to the resilience of the entire community.

Online Shopping & Tax-Free Holidays: Navigating the Digital Landscape

The digital age has transformed the way we shop, and tax-free holidays are no exception. But navigating the world of online retail during these periods requires careful attention to specific rules and regulations. Can you snag those tax-free deals from the comfort of your couch? The answer is generally yes, but with a few crucial caveats.

Are Online Purchases Eligible?

Generally, online purchases do qualify for tax exemption during Florida's sales tax holidays, provided that the sale meets all the usual requirements: the items must be eligible, and the purchase must occur during the designated holiday period. However, the date of the transaction is key.

The transaction date, not the shipping or delivery date, determines eligibility.

For instance, if the holiday ends at 11:59 PM on a Sunday, your online order must be placed and processed before that deadline to qualify for the exemption.

Shipping Costs and Sales Tax: What You Need to Know

Shipping and handling charges can be tricky. If the items you're buying are tax-exempt and the shipping charges are separately stated on your invoice, sales tax generally should not apply to the shipping costs.

However, if the shipping fee is bundled into the price of the item, or if the retailer charges a single "delivery fee" that covers both taxable and tax-exempt items, the waters can get a bit murkier.

It's always best to check with the retailer directly or consult the Florida Department of Revenue's guidelines for specific clarification.

Strategic Online Shopping for Maximum Savings

Here are some tips to maximize your savings when shopping online during tax-free holidays:

- Plan Ahead: Create a list of the items you need well in advance. This helps you avoid impulse purchases and ensures you're focusing on eligible items.

- Check Retailer Policies: Before the holiday begins, check the websites of your favorite retailers to understand their policies regarding online sales tax exemptions, shipping costs, and return policies.

- Shop Early: Don't wait until the last minute to place your order. High website traffic and potential processing delays could cause you to miss the deadline.

- Keep Records: Save all order confirmations and receipts. These documents may be useful if you need to resolve any discrepancies or make returns.

- Compare Prices: Just because an item is tax-free doesn't necessarily mean it's the best deal. Compare prices across different retailers to ensure you're getting the most for your money.

By understanding the rules and adopting a strategic approach, you can successfully navigate the digital landscape and take full advantage of Florida's tax-free holidays from the convenience of your own home.

Online retailers have adapted, often extending their promotions to coincide with these tax-free periods. The benefits, however, extend far beyond the individual consumer, rippling outwards to boost the local economy.

Who Wins with Tax-Free Weekends? Benefits for Residents & Businesses

Florida's tax-free holidays aren't just about saving a few dollars on school supplies or hurricane preparedness kits. They represent a strategic economic initiative designed to benefit both residents and businesses throughout the Sunshine State. By temporarily suspending sales tax on specific items, the state creates a win-win situation, stimulating the economy while providing much-needed relief to consumers.

Reduced Costs for Florida Residents

The most direct and obvious beneficiaries of tax-free weekends are, of course, Florida residents.

By eliminating sales tax on essential items, these holidays effectively lower the cost of living, particularly for families with children or those preparing for potential disasters.

Consider the Back-to-School Sales Tax Holiday: the savings on clothing, school supplies, and computers can significantly ease the financial burden on parents as they prepare their children for the academic year.

Similarly, the Disaster Preparedness Sales Tax Holiday allows residents to stock up on crucial emergency supplies without the added expense of sales tax, promoting a culture of preparedness without straining household budgets. This is especially important in a state frequently impacted by hurricanes.

These savings, while seemingly small on individual items, can add up to a substantial amount, freeing up household income for other needs and investments.

Boosting Business for Florida Retailers

While residents enjoy the immediate benefits of tax savings, Florida businesses also stand to gain significantly from these strategically timed holidays.

The surge in consumer spending during these periods translates directly into increased sales volume for retailers across the state.

This increased demand can lead to higher revenues, improved cash flow, and the ability to invest in growth and expansion.

Furthermore, tax-free holidays can attract customers who might not otherwise make a purchase, introducing them to new products and services and fostering long-term customer relationships.

The increased foot traffic in brick-and-mortar stores during these events can also benefit neighboring businesses, creating a positive spillover effect throughout the local economy. For many small businesses, these weekends can be crucial for meeting quarterly sales goals.

A Mutually Beneficial Cycle

The benefits to residents and businesses are not mutually exclusive; rather, they create a positive feedback loop.

Increased consumer spending driven by tax savings fuels business growth, which in turn creates jobs and stimulates further economic activity.

This cycle benefits the entire state, contributing to a stronger and more resilient economy.

By strategically targeting essential items and aligning the holidays with key events like back-to-school season and hurricane season, Florida ensures that these tax-free initiatives provide maximum value to both residents and businesses alike.

Boosting Business for Florida Retailers While residents enjoy the immediate benefits of tax-free savings, Florida businesses also reap significant rewards. The increased foot traffic and sales volume during these holidays provide a vital boost to the local economy, particularly for retailers specializing in eligible goods.

Exploring Other Tax-Saving Opportunities in Florida

Florida's popular sales tax holidays are undoubtedly valuable, but savvy residents should also be aware of other potential tax-saving opportunities that may be available throughout the year. While less publicized, these exemptions and credits can provide additional financial relief for those who qualify.

It's important to remember that tax laws and regulations can be complex and are subject to change. Therefore, it's always best to consult with a qualified tax professional or refer to official sources for the most up-to-date information.

Property Tax Exemptions: Homestead and More

Beyond sales tax, Florida offers several property tax exemptions that can significantly reduce the tax burden on homeowners. The most well-known is the homestead exemption, which provides a reduction in assessed value for eligible primary residences.

This exemption not only lowers your property tax bill but also provides certain protections against creditors. Other property tax exemptions may be available for veterans, seniors, and individuals with disabilities.

It's crucial to research and understand the eligibility requirements for each exemption to ensure you're taking full advantage of available benefits.

Sales Tax Exemptions for Specific Goods and Services

While the sales tax holidays offer temporary relief on specific items, Florida also provides permanent sales tax exemptions for certain goods and services. These exemptions often target essential items or industries that the state seeks to promote.

For example, food purchased for home consumption is generally exempt from sales tax in Florida. Similarly, certain agricultural products and equipment may be exempt to support the state's agricultural industry.

Businesses should also be aware of potential sales tax exemptions for manufacturing equipment or other business-related purchases.

Tax Credits and Deductions: Unlocking Further Savings

In addition to exemptions, Florida taxpayers may also be eligible for various tax credits and deductions that can reduce their overall tax liability. These credits and deductions can be related to education, healthcare, or other specific expenses.

For instance, families may be able to claim a tax credit for certain educational expenses, such as tuition or school supplies. Individuals may also be able to deduct medical expenses that exceed a certain percentage of their adjusted gross income.

Exploring these potential credits and deductions can uncover additional savings opportunities that complement the benefits of sales tax holidays.

Resources for Further Research

Navigating Florida's tax laws can be challenging, but several resources are available to help taxpayers understand their rights and obligations. The Florida Department of Revenue website is a valuable source of information on various tax-related topics, including exemptions, credits, and deductions.

Taxpayers can also consult with qualified tax professionals, such as certified public accountants (CPAs) or tax attorneys, for personalized advice and guidance. These professionals can help individuals and businesses identify potential tax-saving opportunities and ensure compliance with all applicable laws and regulations.

By taking the time to research and understand Florida's tax laws, residents can unlock additional savings and improve their overall financial well-being.

Video: Florida Tax-Free: The ULTIMATE Savings Guide REVEALED!

FAQs: Florida Tax-Free Savings

Here are some frequently asked questions to help you maximize your savings with Florida's tax-free initiatives.

What exactly does "Florida Tax Free" mean?

"Florida Tax Free" commonly refers to sales tax holidays where certain items are exempt from sales tax for a limited time. These holidays help families save money on essential back-to-school items, hurricane preparedness supplies, or even energy-efficient appliances. The specific items and dates vary each year, so it's important to stay informed.

How do I find out when the next Florida tax-free holiday is?

The Florida Department of Revenue website is the best place to get accurate and up-to-date information. You can also sign up for email alerts or follow their social media channels for announcements about upcoming Florida tax free periods.

What kind of items are typically included in Florida tax-free holidays?

Typically, these sales tax holidays focus on back-to-school supplies like clothing, school supplies, and computers/electronics. There may also be other sales tax holidays focusing on disaster preparedness and energy efficiency. However, the items eligible for Florida tax free periods change, so always check the specific holiday guidelines.

Are there any restrictions on how much an item can cost to qualify for Florida tax-free savings?

Yes, often there are price limits on items to qualify for the tax exemption. For example, clothing might need to be under a certain price per item. Check the official guidelines for each specific Florida tax free holiday, as these limitations can change yearly.